The Best Cheap Renters Insurance in Montana (2025)

State Farm has the best and cheapest renters insurance in Montana at $9 per month for $30,000 of personal property coverage.

Compare Renters Insurance Quotes in Montana

Best Cheap Renters Insurance in MT

We picked the best renters insurance companies in Montana by comparing their cost, customer service, extra coverage options and discounts.

Rates are for a policy with $30,000 of property coverage using quotes from 20 of Montana's largest cities. See the full methodology.

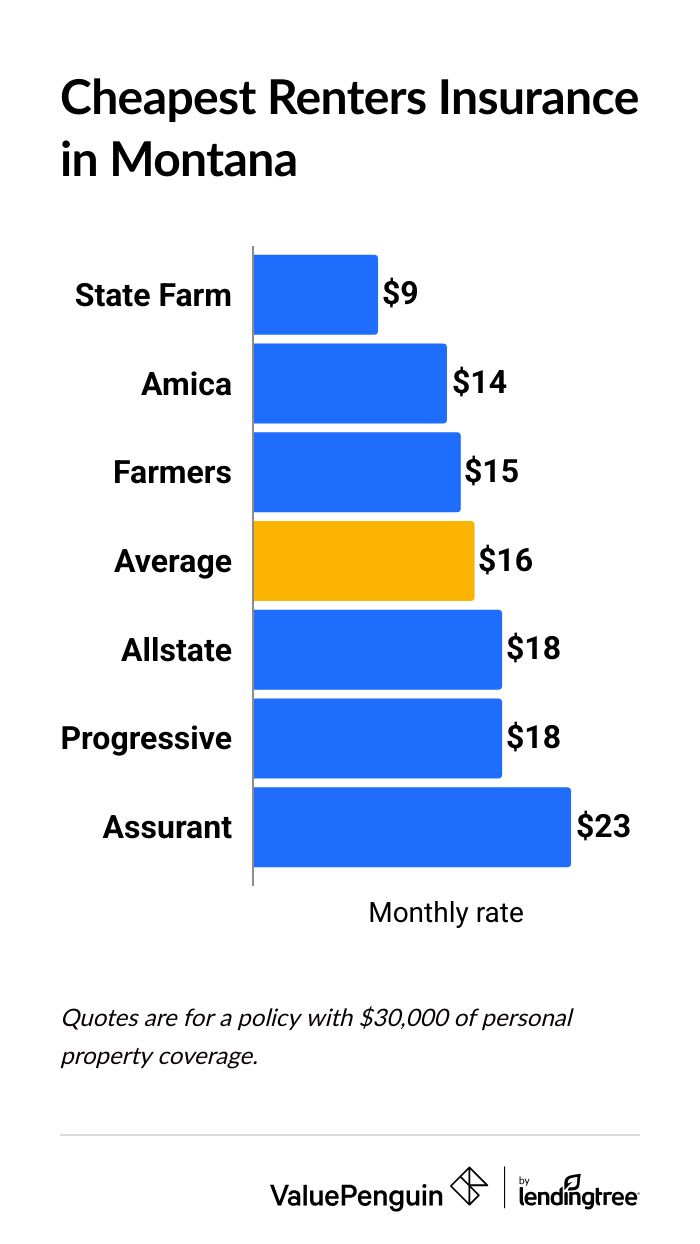

Cheapest renters insurance in Montana

State Farm has the cheapest renters insurance in Montana, at an average of $9 per month or $104 per year.

State Farm renters insurance is nearly half the price of the Montana state average, making it the best deal for most people.

Compare Cheap Renters Insurance Quotes in Montana

Amica and Farmers also have cheap renters insurance in Montana, with average rates between $14 and $15 per month. That's slightly cheaper than the average cost of renters insurance in Montana, which is $16 per month.

Cheapest renters insurance companies in Montana

Company | Monthly cost | ||

|---|---|---|---|

| State Farm | $9 | ||

| Amica | $14 | ||

| Farmers | $15 | ||

| Allstate | $18 | ||

| Progressive | $18 | ||

Cheapest and best overall renters insurance: State Farm

-

Cost$9/moThis analysis used renters insurance quotes for 20 of Montana's largest cities. Read our methodology.

Best customer service: Amica

-

Cost$14/moThis analysis used renters insurance quotes for 20 of Montana's largest cities. Read our methodology.

Best renters insurance for discounts: Farmers

-

Cost$15/moThis analysis used renters insurance quotes for 20 of Montana's largest cities. Read our methodology.

Montana renters insurance costs by city

Laurel, MT, has the most expensive rates among the state's larger cities, with an average of $23 per month in the Billings suburb.

Anaconda, Kalispell, Livingston and Polson have some of the state's cheaper rates, at $15 per month.

City | Monthly rate | % from average |

|---|---|---|

| Anaconda | $15 | -5% |

| Belgrade | $16 | -2% |

| Bigfork | $16 | 2% |

| Billings | $17 | 6% |

| Bozeman | $16 | -2% |

Where you live is one of the biggest factors in how much you'll pay for renters insurance. Areas that are likely to see major disasters, like floods or fires, may have more expensive renters insurance rates. Areas with low crime rates might have cheaper prices.

How to get the best renters insurance in Montana

Shopping around and looking for discounts are the best ways to get a good renters insurance policy for a low rate.

- Shop around to compare rates: Each insurance company uses a different method for setting its rates. For example, one company might place more importance on your credit score and another company might look at your claims history. Getting renters insurance quotes from multiple companies is the best way to find low rates for your situation.

- Get discounts: You could save on your renters insurance in simple ways such as paying your bill on time or signing up for paperless billing. Make sure you sign up for as many discounts as you're eligible for so that you're not paying more for insurance than you need to.

Common renters insurance risks in Montana

Wildfires: Renters insurance usually covers fire and smoke unless your policy specifically excludes it. Wildfires can be a common threat in Montana, causing thousands of acres to burn each year, which can be worsened by the state's severe droughts.

Winter freezes: Renters insurance policies cover damage from winter storms, snow, ice, wind, hail and falling objects. The cold and snowy winters of Montana could cause damage to your rental if your pipes freeze or if an icy tree falls on your home.

Earthquakes: If you live in one of the areas of western Montana that are at risk of earthquakes, you may want to add on coverage for earthquakes to your renters insurance policy. Earthquakes could cause damage to your belongings, such as if your electronics and housewares fall and break.

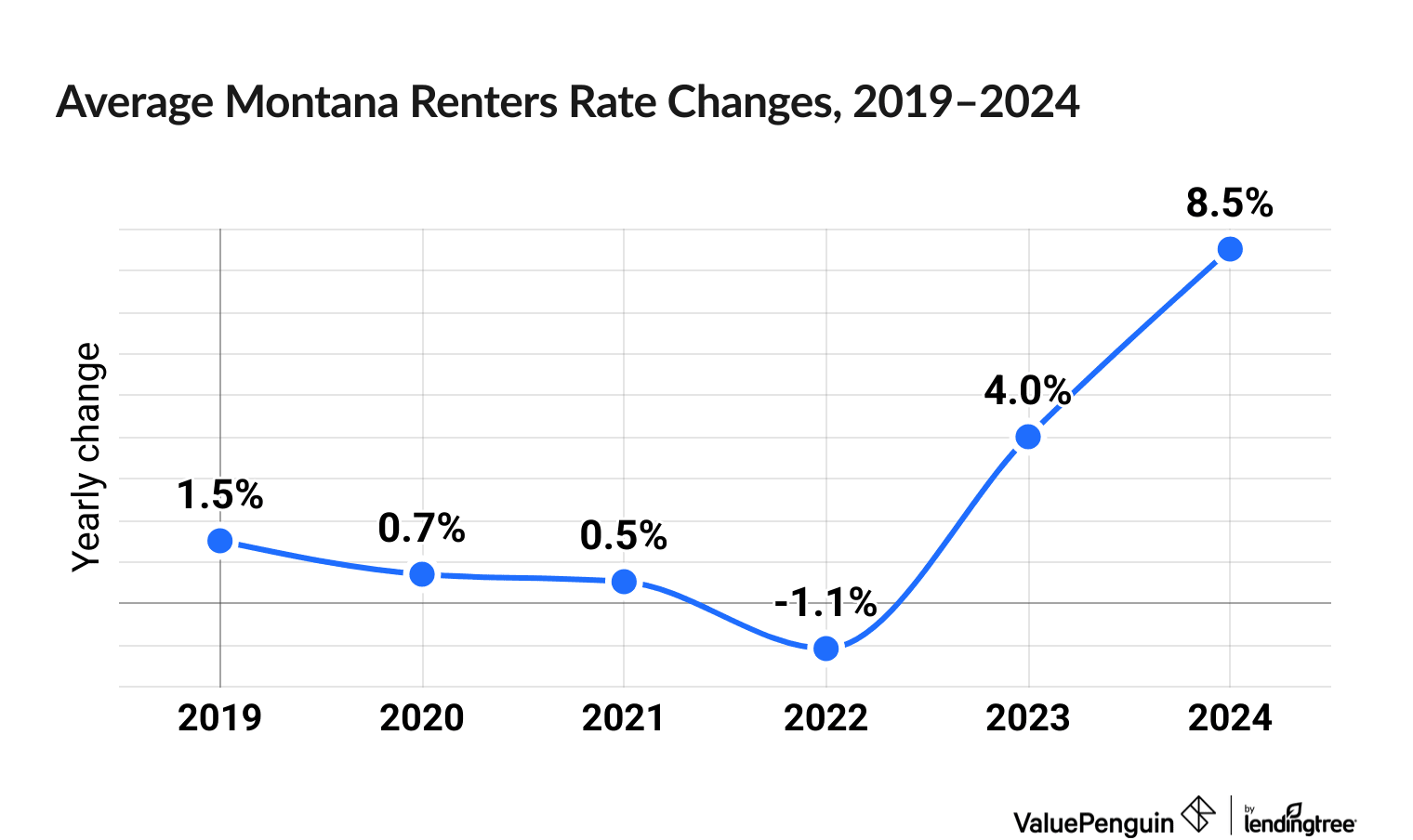

Montana renters insurance trends

Renters insurance prices have gone up 14.8% in Montana over the last six years.

Montana renters insurance rates went up between 3.5% to 62.7%, depending on the company, over the last six years.

Renters insurance prices, on average, decreased by 1.1% in 2022, but then increased by 12.9% across 2023 and 2024.

Among the major MT insurers, the biggest increases have been at USAA (62.7%), Nationwide (42.3%) and Farmers Union Mutual (20.9%).

Renters insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

How much is renters insurance in Montana?

The average cost of renters insurance in Montana is $16 per month. Renters can find the cheapest rates in Montana with State Farm, which costs an average of $9 per month.

Is renters insurance required in Montana?

Renters insurance is not required by law in Montana, but your landlord might require you to get renters insurance.

How much is renters insurance in Billings, MT?

Renters insurance in Billings costs an average of $17 per month or $202 per year. That's 6% more expensive than the Montana state average. People living in Missoula pay $16 per month for the same coverage, in comparison.

Methodology

To find the best renters insurance prices in Montana, ValuePenguin experts collected quotes from six major companies across 20 of the largest cities in the state.

Quotes are for an unmarried 30-year-old woman with no claim history. Coverage limits include:

- $30,000 of personal property coverage

- $9,000 loss of use coverage

- $500 deductible

- $100,000 of personal liability

- $1,000 of medical payments to guests

These rates should be used for comparative purposes only. Your quotes may differ.

Editor ratings are based on affordability, complaint data from the National Association of Insurance Commissioners (NAIC), customer satisfaction ratings from J.D. Power's 2023 survey, and coverage options.

About the Author

Analyst

Stephanie Guinan is an Analyst for ValuePenguin/LendingTree. She specializes in simplifying complex insurance topics for consumers.

She’s also worked as an award-winning data journalist and content marketing writer. Stephanie’s work has been cited by Wall Street Journal, New York Times, Rolling Stone and more.

Expertise

- Health insurance and Medicare

- Home and auto insurance

- Crunching numbers

Referenced by

- Wall Street Journal

- New York Times

- Rolling Stone

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.