Telematics Insurance: Is It Right for You?

Telematics programs work well for safe or low-mileage drivers. Users agree to share their driving data with their insurance company in... Read More

Finding a car insurance company based near you can come with a lot of benefits.

Find Cheap Liability-Only Car Insurance in Your Area

Find Cheap Liability-Only Car Insurance in Your Area

Smaller regional companies tend to offer cheap rates and reliable customer service. You might find it easier to work with an agent whose office is nearby versus someone located in a call center across the country.

Many large insurance companies and regional providers have local agents who understand the needs of drivers near you. Additionally, working with someone near you can make the claims process much easier if you're ever in an accident.

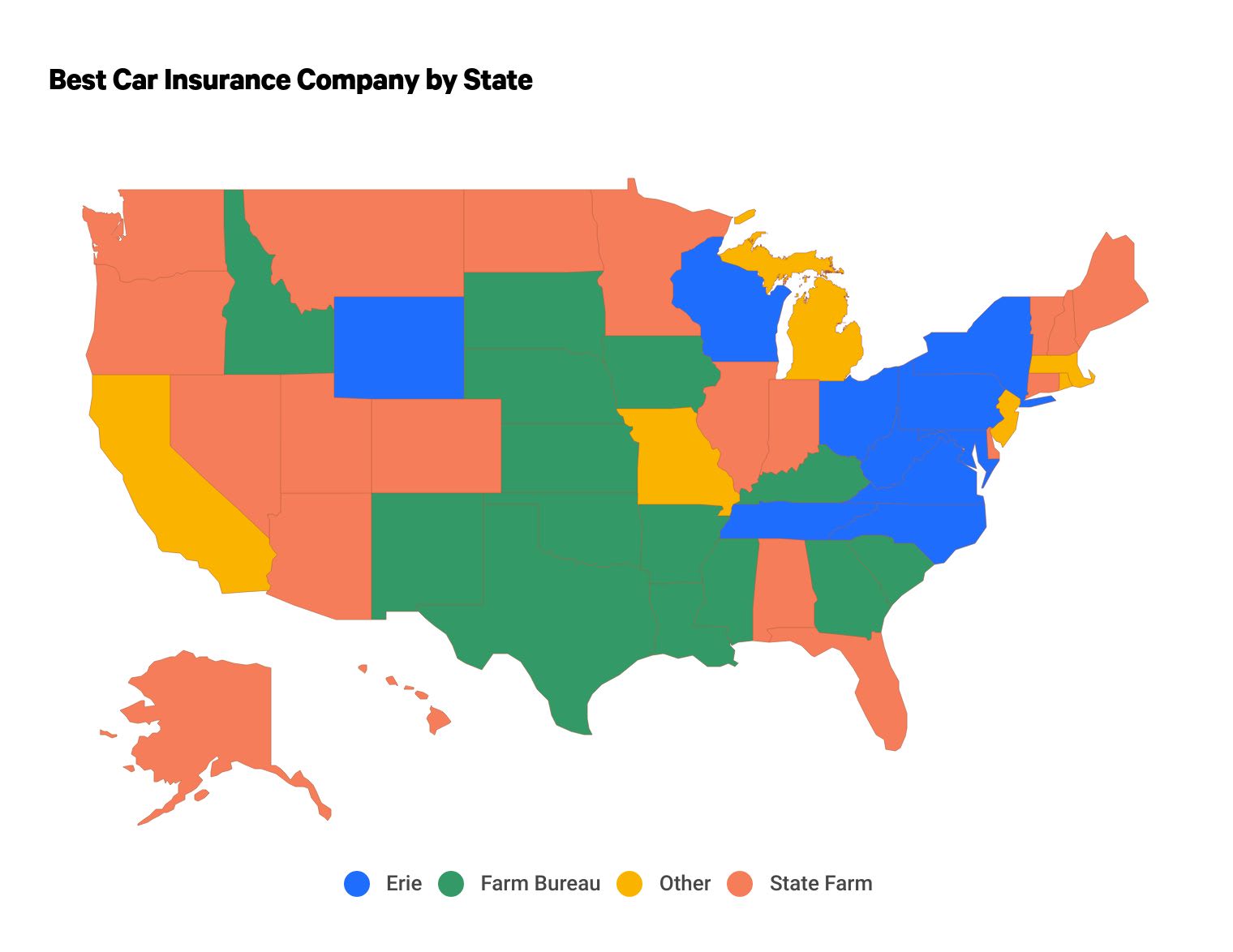

State Farm is the best car insurance company in 21 states based on customer service reviews, coverage availability and the overall value it provides to drivers across the country.

However, the best car insurance near you may be different. Farm Bureau and Erie offer dependable customer service and affordable rates in the states where they sell insurance.

The best car insurance near you also depends on factors like your driving history and age. For that reason, it's important to compare quotes from multiple companies to find the best company for you.

Where you live can have a big impact on your car insurance rates. For example, drivers in Vermont pay $92 per month for full coverage auto insurance, on average. People living in Michigan pay four times as much for the same coverage, at $399 per month.

It's important to compare rates from a handful of companies near you to find the best price for car insurance.

Telematics programs work well for safe or low-mileage drivers. Users agree to share their driving data with their insurance company in... Read More

Of the 179,696 crash fatalities from 2015 to 2019 on U.S. roads, California and Texas accounted for 10% each of the deaths.... Read More

Against expert advice, 59% of Americans plan to set off fireworks on their own this... Read More

In 2024, Medicare Part B costs $174.70 per month. Part B covers medical care for doctor visits, tests and... Read More

Learn how to protect yourself from surprise medical bills by understanding what "out of network" means and how your health insurance plan... Read More

Productivity and mental health suffer because of these... Read More

We generally do not recommend Travelers IntelliDrive to most drivers. The company raises rates if you perform poorly during the monitoring... Read More

Westfield Insurance, which works mainly in Ohio and the Midwest, offers good rates, especially for minimum coverage. The customer service... Read More

Many consumers turn to natural remedies, with 72% avoiding conventional medication when... Read More

No deductible health insurance means your insurer starts paying for your health care sooner, and these plans can be useful for those with... Read More

Because more people were at home, sports-related injuries also dropped in 2020 compared to the year before — though that wasn’t the... Read More

Low wages and high insurance costs make owning a car an expensive proposition in some... Read More

Most states require drivers to carry proof of car insurance. This is often a card kept in the car or information on your phone showing your... Read More

A car insurance broker is a professional who can help guide you as you look for a policy. Using an insurance broker can add to your costs,... Read More

The best way to get child-only health insurance is through Healthcare.gov, Medicaid or CHIP. The cost of insurance for kids can be free, if... Read More

The coronavirus crisis accelerated movement away from some crowded metropolitan areas in favor of less densely populated suburbs. That... Read More

Seventy-one percent of Americans will attend or host a summer barbecue this year, but a new ValuePenguin survey finds grilling hazards... Read More

Tower Hill has the best homeowners insurance for most people in Florida because of its low rates and good coverage options. Allstate and... Read More

State Farm usually has the cheapest rates among national car insurance companies. However, a smaller regional company like Auto-Owners, Erie or Farm Bureau may have the cheapest rates near you.

This depends on how you prefer to communicate with your insurance company. If you're looking for a one-on-one relationship, or prefer speaking with someone in person or on the phone, then a local agent is the best choice for you. However, if you're more comfortable managing your insurance with an app and prefer virtual chat to phone calls, you may not benefit from working with a local agent.

To find rates by state, ValuePenguin compared quotes from the top insurance companies in each state. Rates are for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX.

Full coverage limits are greater than any one state's minimum requirement. Full coverage also includes comprehensive coverage, collision coverage and uninsured/underinsured motorist bodily injury coverage.

The best car insurance companies offered quotes in at least five states. ValuePenguin editors rated insurance companies based on J.D. Power customer satisfaction survey scores, data from the National Association of Insurance Commissioners (NAIC) complaint index, coverage availability and the overall value provided to customers.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.