What to Do After a Hit-and-Run in Texas

Hit-and-runs in Texas are serious offenses, carrying penalties up to 20 years in prison. If you're the victim of a hit-and-run, gather all... Read More

Finding a car insurance company based near you can come with a lot of benefits.

Find Cheap Liability-Only Car Insurance in Your Area

Find Cheap Liability-Only Car Insurance in Your Area

Smaller regional companies tend to offer cheap rates and reliable customer service. You might find it easier to work with an agent whose office is nearby versus someone located in a call center across the country.

Many large insurance companies and regional providers have local agents who understand the needs of drivers near you. Additionally, working with someone near you can make the claims process much easier if you're ever in an accident.

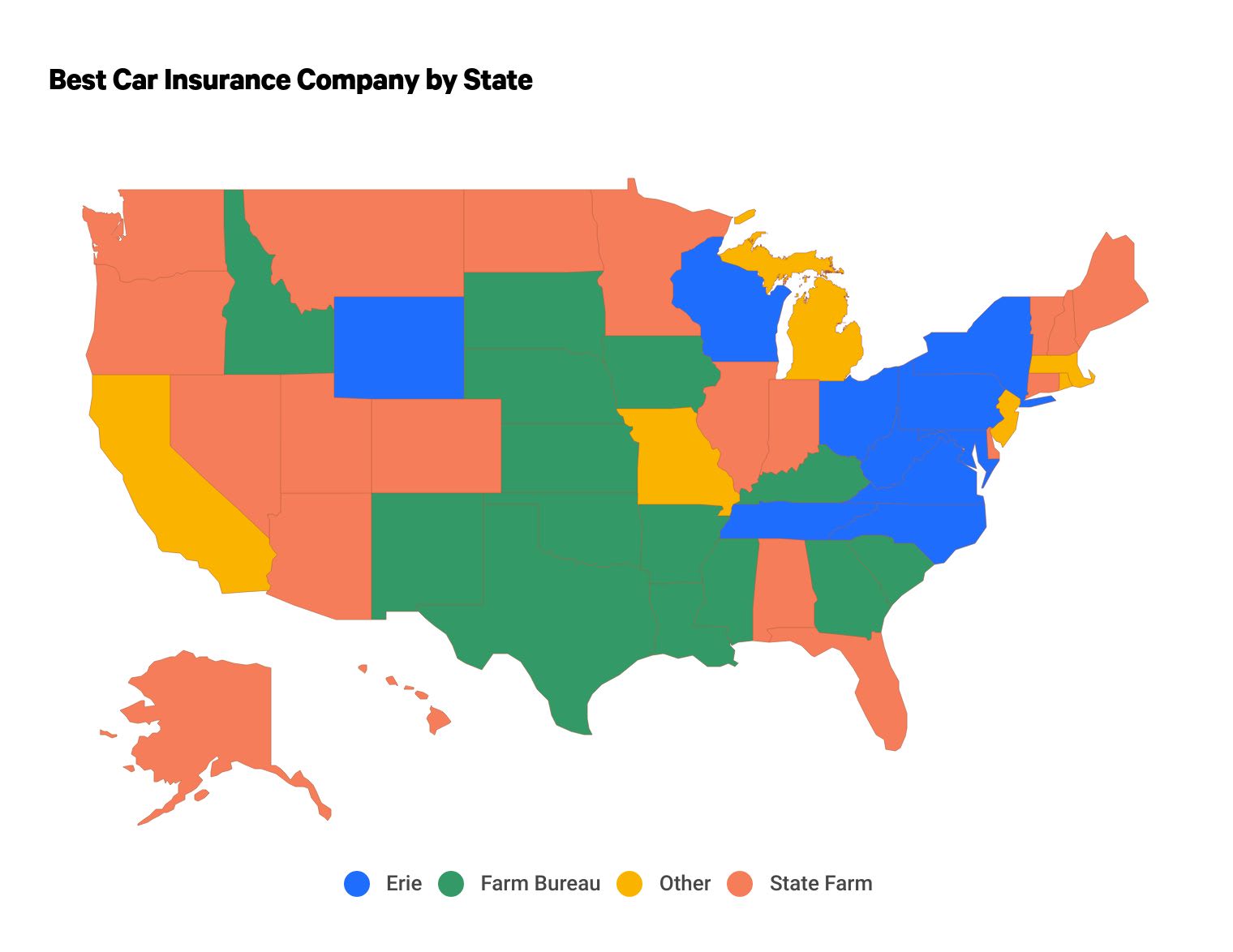

State Farm is the best car insurance company in 21 states based on customer service reviews, coverage availability and the overall value it provides to drivers across the country.

However, the best car insurance near you may be different. Farm Bureau and Erie offer dependable customer service and affordable rates in the states where they sell insurance.

The best car insurance near you also depends on factors like your driving history and age. For that reason, it's important to compare quotes from multiple companies to find the best company for you.

Where you live can have a big impact on your car insurance rates. For example, drivers in Vermont pay $92 per month for full coverage auto insurance, on average. People living in Michigan pay four times as much for the same coverage, at $399 per month.

It's important to compare rates from a handful of companies near you to find the best price for car insurance.

Hit-and-runs in Texas are serious offenses, carrying penalties up to 20 years in prison. If you're the victim of a hit-and-run, gather all... Read More

In the last decade, Austin has jumped in popularity as a place to live, thanks to its high quality of life and sunny, warm climate. But... Read More

You should add to your car insurance anyone who regularly uses your vehicle or has a license and lives with you.... Read More

You can get an elevation certificate by contacting a floodplain manager, land surveyor or engineer. A certificate might lower your flood... Read More

7-day insurance was a type of car insurance that was once available in Michigan. It was mostly used as a loophole to drive without... Read More

It's possible to get life insurance if you have diabetes, but the cost and coverage options will depend on your age, type of diabetes and... Read More

A car insurance policy number identifies your policy to your insurance company and the government. You'll need it when you want to make a... Read More

Gap insurance is not required in Florida, but drivers in the state may need to buy it to get a lease or auto loan. Although you can buy gap... Read More

You need an SR-22 in Illinois to prove that you have insurance after you’re convicted of certain driving violations. SR-22 insurance can... Read More

Lemonade has the best cheap renters insurance in Los Angeles, with an average policy that costs around $10 per month. That's half the price... Read More

Approximately 85% of homeowners have a home insurance policy. While it's not a required form of coverage, home insurance is typically... Read More

Ameriprise home insurance is fine if you're looking for affordable rates, good coverage and solid customer service. However, its auto... Read More

To calculate the right amount of renters insurance for your apartment, you should add up the value of your property, decide how much... Read More

Security First is a Florida-focused homeowners insurance company with poor customer service reviews, high rates and limited flexibility in... Read More

ASI's high home insurance rates and poor customer service reviews mean you can probably find better coverage elsewhere. Its rates are more... Read More

To understand the current landscape of consumer banking, we examined data from a variety of sources on topics ranging from banking... Read More

Life insurance after a cancer diagnosis is more expensive, and you may have limited options, but most cancer patients and survivors are... Read More

Federated National has competitive home insurance rates but poor customer service. Nevertheless, limited choices for Florida homeowners... Read More

State Farm usually has the cheapest rates among national car insurance companies. However, a smaller regional company like Auto-Owners, Erie or Farm Bureau may have the cheapest rates near you.

This depends on how you prefer to communicate with your insurance company. If you're looking for a one-on-one relationship, or prefer speaking with someone in person or on the phone, then a local agent is the best choice for you. However, if you're more comfortable managing your insurance with an app and prefer virtual chat to phone calls, you may not benefit from working with a local agent.

To find rates by state, ValuePenguin compared quotes from the top insurance companies in each state. Rates are for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX.

Full coverage limits are greater than any one state's minimum requirement. Full coverage also includes comprehensive coverage, collision coverage and uninsured/underinsured motorist bodily injury coverage.

The best car insurance companies offered quotes in at least five states. ValuePenguin editors rated insurance companies based on J.D. Power customer satisfaction survey scores, data from the National Association of Insurance Commissioners (NAIC) complaint index, coverage availability and the overall value provided to customers.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.