What Is PLPD Insurance?

PLPD Insurance, also called liability insurance, covers the costs of injuries and property damage to the other party in car accidents where... Read More

Finding a car insurance company based near you can come with a lot of benefits.

Find Cheap Liability-Only Car Insurance in Your Area

Find Cheap Liability-Only Car Insurance in Your Area

Smaller regional companies tend to offer cheap rates and reliable customer service. You might find it easier to work with an agent whose office is nearby versus someone located in a call center across the country.

Many large insurance companies and regional providers have local agents who understand the needs of drivers near you. Additionally, working with someone near you can make the claims process much easier if you're ever in an accident.

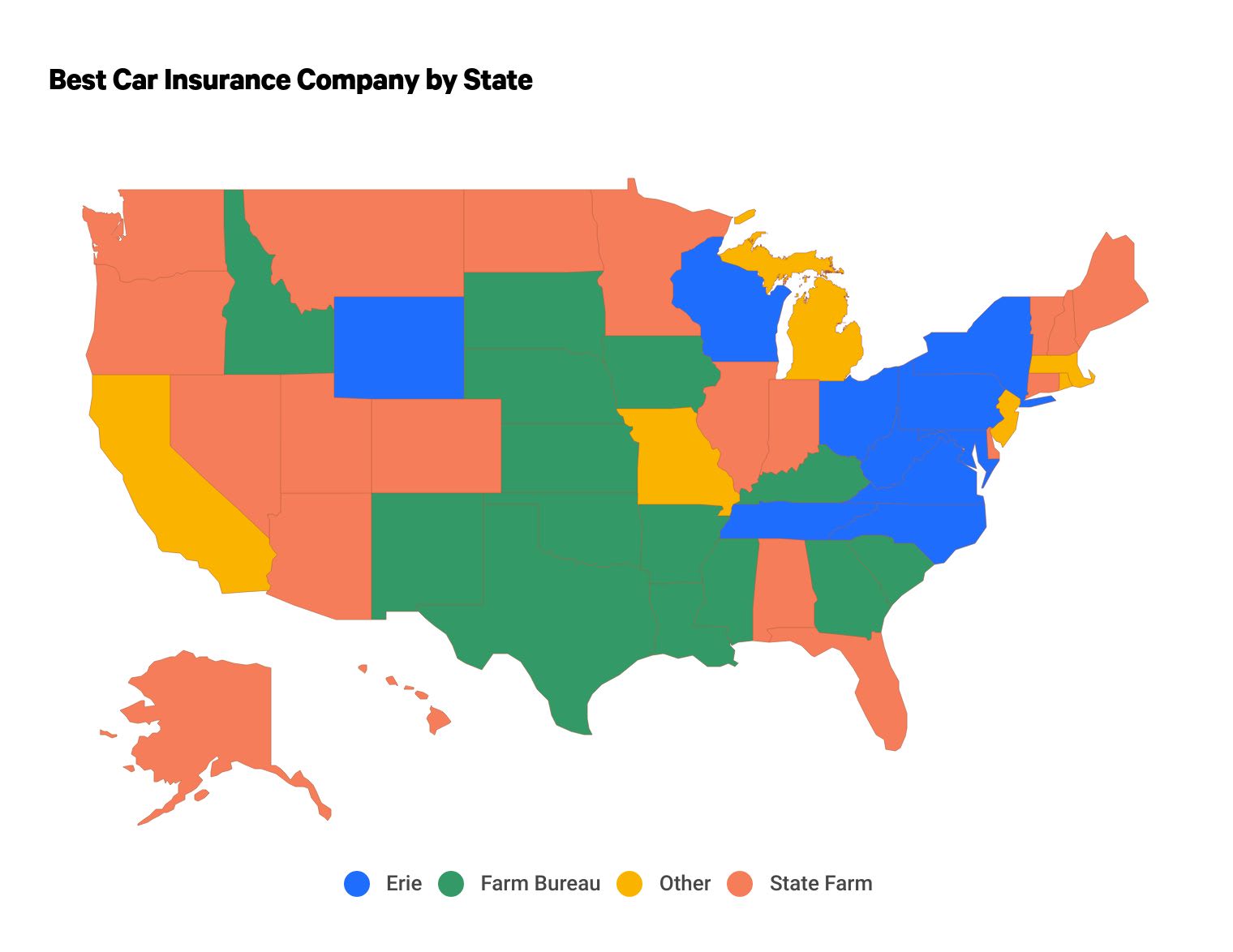

State Farm is the best car insurance company in 21 states based on customer service reviews, coverage availability and the overall value it provides to drivers across the country.

However, the best car insurance near you may be different. Farm Bureau and Erie offer dependable customer service and affordable rates in the states where they sell insurance.

The best car insurance near you also depends on factors like your driving history and age. For that reason, it's important to compare quotes from multiple companies to find the best company for you.

Where you live can have a big impact on your car insurance rates. For example, drivers in Vermont pay $92 per month for full coverage auto insurance, on average. People living in Michigan pay four times as much for the same coverage, at $399 per month.

It's important to compare rates from a handful of companies near you to find the best price for car insurance.

PLPD Insurance, also called liability insurance, covers the costs of injuries and property damage to the other party in car accidents where... Read More

Knowing Michigan's motorcycle, moped and ORV laws can help you avoid fines while on the road.... Read More

The average monthly motorcycle insurance cost for an 18-year-old is $79. Dairyland offers the cheapest rate at $811 per... Read More

There are several types of car insurance coverage that may cover the cost of your ambulance after a car accident, and your health insurance... Read More

Violating Wisconsin's motorcycle, moped and ATV laws can lead to fines. Read about licensing, registration and insurance requirements... Read More

Florida boat owners aren't required to buy insurance or obtain a license in order to operate a boat. However, owners will typically be... Read More

Most people don't need to carry a life insurance policy for their whole lives. If you've paid for your life's most significant expenses,... Read More

Hippo home insurance is cheaper than its competitors — a policy costs $1,761 per year, on average. Hippo also includes extra useful... Read More

A few states offer cheap auto insurance to low-income families. But even if yours doesn't, people near the poverty line can save on car... Read More

Depending on your coverage, certain hurricane damage may be covered by your homeowners or renters insurance policy. However, you may also... Read More

If you drive a motorcycle, scooter or moped, you likely need a motorcycle license to legally operate your vehicle, no matter your state.... Read More

Here's what you should know when looking for a motorcycle roadside assistance plan you can count on when you — and your bike — need... Read More

The loss of use (coverage D) portion of your homeowners and renters insurance reimburses you for the cost of additional living expenses... Read More

Harley-Davidson Insurance has cheap rates, great discounts and good coverage options, whether you have a Harley motorcycle or not. The... Read More

Drivers for rideshare companies, such as Uber and Lyft, are required by Florida law to have insurance coverage whenever the rideshare app... Read More

AAA insurance is expensive but comes with good coverage options. Customer service quality depends on where you live, though, and you have... Read More

TruStage offers a car insurance discount to credit union members through Liberty Mutual. Liberty Mutual has lots of discount opportunities... Read More

A motorcycle's blue book value tells you how much your bike is worth on the private market, which can help you make a good purchase or... Read More

State Farm usually has the cheapest rates among national car insurance companies. However, a smaller regional company like Auto-Owners, Erie or Farm Bureau may have the cheapest rates near you.

This depends on how you prefer to communicate with your insurance company. If you're looking for a one-on-one relationship, or prefer speaking with someone in person or on the phone, then a local agent is the best choice for you. However, if you're more comfortable managing your insurance with an app and prefer virtual chat to phone calls, you may not benefit from working with a local agent.

To find rates by state, ValuePenguin compared quotes from the top insurance companies in each state. Rates are for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX.

Full coverage limits are greater than any one state's minimum requirement. Full coverage also includes comprehensive coverage, collision coverage and uninsured/underinsured motorist bodily injury coverage.

The best car insurance companies offered quotes in at least five states. ValuePenguin editors rated insurance companies based on J.D. Power customer satisfaction survey scores, data from the National Association of Insurance Commissioners (NAIC) complaint index, coverage availability and the overall value provided to customers.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.