How Does Personal Injury Protection (PIP) Work in Oregon?

Personal injury protection (PIP) insurance is required for all drivers in Oregon and must provide at least $15,000 of coverage per person... Read More

Finding a car insurance company based near you can come with a lot of benefits.

Find Cheap Liability-Only Car Insurance in Your Area

Find Cheap Liability-Only Car Insurance in Your Area

Smaller regional companies tend to offer cheap rates and reliable customer service. You might find it easier to work with an agent whose office is nearby versus someone located in a call center across the country.

Many large insurance companies and regional providers have local agents who understand the needs of drivers near you. Additionally, working with someone near you can make the claims process much easier if you're ever in an accident.

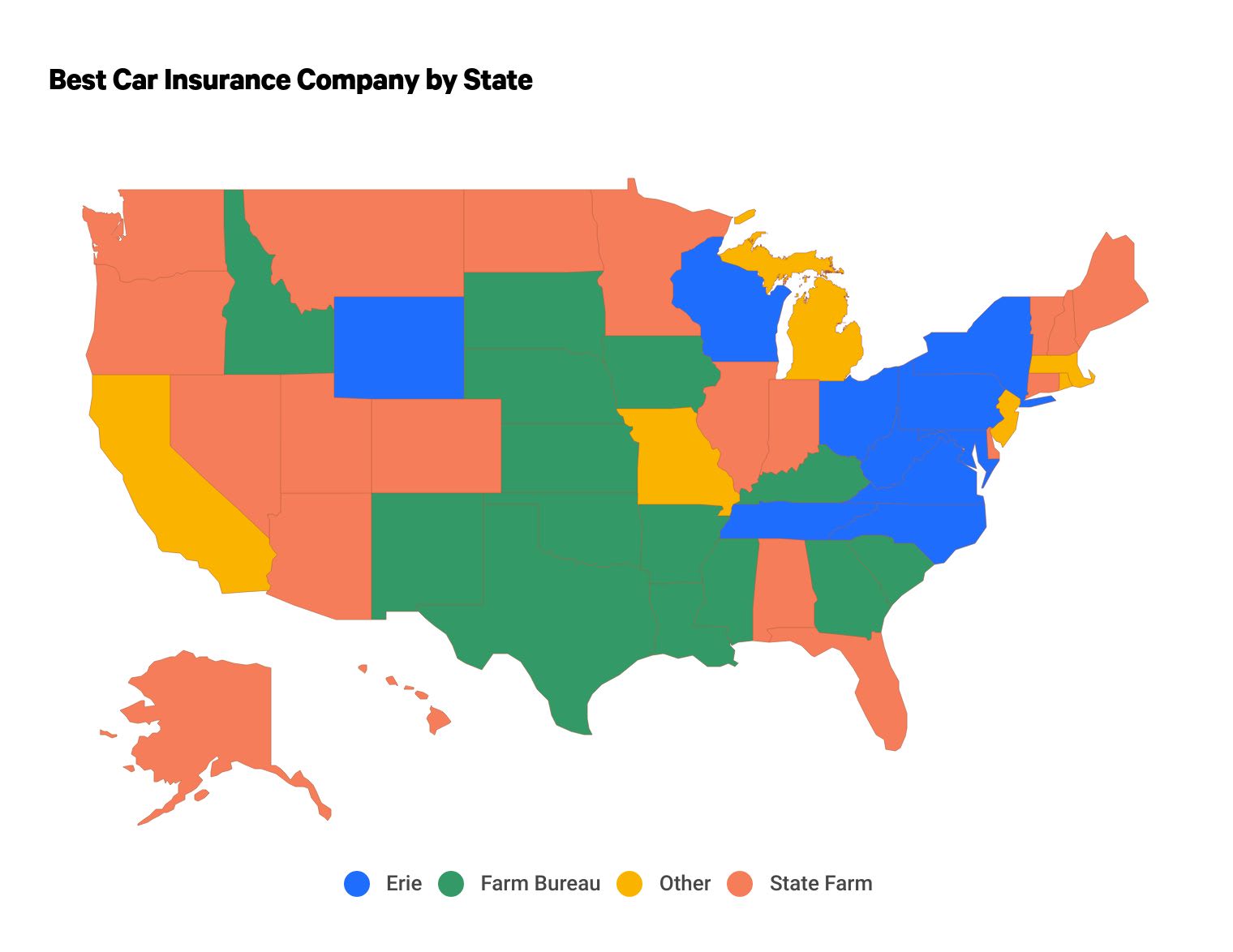

State Farm is the best car insurance company in 21 states based on customer service reviews, coverage availability and the overall value it provides to drivers across the country.

However, the best car insurance near you may be different. Farm Bureau and Erie offer dependable customer service and affordable rates in the states where they sell insurance.

The best car insurance near you also depends on factors like your driving history and age. For that reason, it's important to compare quotes from multiple companies to find the best company for you.

Where you live can have a big impact on your car insurance rates. For example, drivers in Vermont pay $92 per month for full coverage auto insurance, on average. People living in Michigan pay four times as much for the same coverage, at $399 per month.

It's important to compare rates from a handful of companies near you to find the best price for car insurance.

Personal injury protection (PIP) insurance is required for all drivers in Oregon and must provide at least $15,000 of coverage per person... Read More

Your license and registration may be suspended if you drive without insurance in Arizona.... Read More

The average cost for a 17-year-old driver to get their own auto insurance policy is $737 per month, or $8,844 per year. Erie is the... Read More

Drivers in Delaware are required to carry personal injury protection (PIP) coverage as part of their auto insurance policy. PIP insurance... Read More

Lemonade offers cheap rates for home, renters, car and pet insurance. However, it's not the best fit for everyone — its coverage options... Read More

Private placement life insurance (PPLI) is for wealthy people who want to invest in hedge funds but avoid the high tax rates that come with... Read More

If you fail to maintain auto insurance on a vehicle registered in your name, your license and registration may be suspended.... Read More

License and registration suspensions can occur in Maryland for committing serious driving violations, such as driving without insurance or... Read More

Ladder offers great online term life insurance coverage with competitive rates, particularly if you want a policy with a face value over $1... Read More

Utah requires all car owners to carry personal injury protection (PIP) insurance, which pays for medical costs, lost income and other... Read More

Driving without auto insurance is a misdemeanor offense in Georgia, which could result in the suspension of your registration and license,... Read More

PIP insurance pays for your medical expenses, lost wages and other related costs if you're injured in a car accident. Learn how personal... Read More

Driving without insurance in New Jersey could result in serious penalties, including the suspension of your license or registration.... Read More

Non-standard auto insurance typically refers to the rates you receive from an insurance company, not the coverage. Very risky drivers are... Read More

Haven Life is an online life insurance agency only offers term life insurance, and you can apply for its coverage entirely online and get a... Read More

Personal injury protection car insurance is generally required in Kentucky for all drivers, except motorcyclists. You can choose to reject... Read More

Flexible spending accounts are owned by an employer and are less flexible in comparison to health savings accounts, which are controlled by... Read More

The Coalition Against Insurance Fraud estimates that the insurance industry loses around $308.6 billion per year due to fraud. Between 10%... Read More

State Farm usually has the cheapest rates among national car insurance companies. However, a smaller regional company like Auto-Owners, Erie or Farm Bureau may have the cheapest rates near you.

This depends on how you prefer to communicate with your insurance company. If you're looking for a one-on-one relationship, or prefer speaking with someone in person or on the phone, then a local agent is the best choice for you. However, if you're more comfortable managing your insurance with an app and prefer virtual chat to phone calls, you may not benefit from working with a local agent.

To find rates by state, ValuePenguin compared quotes from the top insurance companies in each state. Rates are for a 30-year-old man with good credit and a clean driving record who drives a 2015 Honda Civic EX.

Full coverage limits are greater than any one state's minimum requirement. Full coverage also includes comprehensive coverage, collision coverage and uninsured/underinsured motorist bodily injury coverage.

The best car insurance companies offered quotes in at least five states. ValuePenguin editors rated insurance companies based on J.D. Power customer satisfaction survey scores, data from the National Association of Insurance Commissioners (NAIC) complaint index, coverage availability and the overall value provided to customers.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.